2023 Market Forecast

Posted By: Rachel Kavanagh

GREATER TORONTO AREA

Balanced conditions are expected to continue in the Greater Toronto housing market into 2023. Move-up and move-over buyers have been driving demand in the region, in a trend that is expected to carry on in the next year. Single-detached homes remain the dominant housing type, followed by condo apartments. Key trends impacting the market in 2023 include interest rate increases and associated price adjustments, rising unemployment due to an economic slowdown, and new opportunities to engage in the market for buyers and sellers due to improved affordability. For buyers, this includes less competition, reduced prices and an increase in choices in the market. Meanwhile, sellers will also have a trade-up advantage, reduced competition of listings, a greater ability to re-locate to the suburbs.

Greater Toronto Area (GTA), Ontario

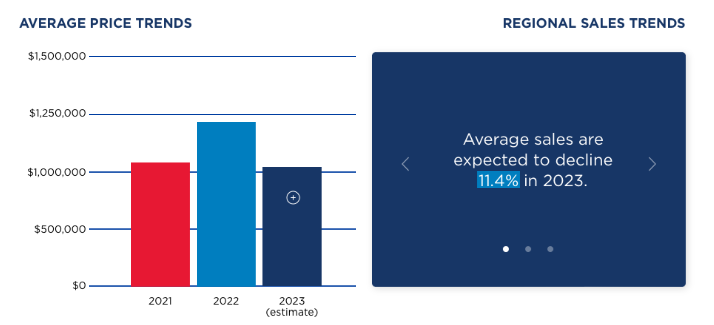

The Greater Toronto Area (GTA) is currently a balanced market – a condition that is anticipated to continue into 2023. Move-up and move-over buyers have been driving demand in the region, in a trend that is expected to carry on in the next year. Meanwhile, single-detached homes remain the dominant housing type, followed by condo apartments. The average residential sale price has increased by 11 per cent from $1,086,155 in 2021 (January-December) to $1,203,916 (January-October) in 2022.

“We’re seeing three main trends that will continue into next year,” says Cameron Forbes, RE/MAX Realtron Realty broker. “Continued interest rate increases and associated price adjustments, rising unemployment due to an economic slowdown, and new opportunities to engage in the market for buyers and sellers because of improved affordability. For buyers, this includes having fewer competitors, reduced prices and an increase in choices in the market. Meanwhile, sellers will have a trade-up advantage, reduced competition of listings, a stronger ability to re-locate to the suburbs, and have all of the advantages that buyers do, too.” The most desirable neighbourhoods in the city are currently based on location and affordability, with access to transit being the largest factor.

Rising interest rates are expected to be a dominant theme in 2023, resulting in a slower market for both buyers and sellers in the GTA. These conditions are impacting first-time buyers in particular, with many choosing to pause their home-buying efforts, due to a lack of affordability. Meanwhile, new construction projects are being delayed as a result of the widening gap between market prices and construction costs, including the impact that higher interest rates have had on financing these projects. The luxury market in Toronto has slowed down and will likely continue to cool in 2023 due to economic pressures. The average residential sale price in the GTA may decrease by up to 11.8% in 2023.

“It’s important to also consider some key context for the GTA. The pandemic years between Spring 2020 and early 2022 were outliers in terms of pricing and demand and factoring out those years in assessing what lies ahead for the region is important as we slowly tilt back to a post-pandemic recovery. This moderating market is an opportunity for homebuyers to take the time to consider their needs, assess opportunities patiently and ultimately make a wise purchasing decision and investment in the long run” adds Alexander.

Additional findings from the 2023 Canadian Housing Market Outlook Report

- Ontario

- In London, Kitchener-Waterloo, Barrie, the GTA, Durham, and Lakelands West (Georgian Bay area) average residential sale prices are expected to decline by two to 15%in 2023.

- Sudbury, Hamilton-Burlington, Oakville, Brampton, Ottawa, Mississauga, Muskoka, Niagara, Windsor, York Region, Haliburton, Peterborough and The Kawarthas, and Kingston are all expected to see average residential sale prices increase between two to eight per cent in 2023.

- 40% of regions in Ontario Canada are considered balanced markets, including London, Kitchener-Waterloo, Oakville, Barrie, Toronto, Windsor, Lakelands West and Kingston.

- Hamilton-Burlington, Brampton, Mississauga and Niagara are all considered buyer’s markets, while Sudbury, Muskoka, Durham York Region, Haliburton, Ottawa and Peterborough and the Kawarthas favour sellers.