Bond Market Pointing to Variable Rates

Posted By: Rachel Kavanagh

Bond Market Pointing to Variable Rates – Expectations have changed since the Bank of Canada’s last rate statement. Many people towards the end of December and early January were wondering if we were going to see numerous rate increases. Now we are wondering if we will only see one.

As it did in December, the central bank left its benchmark rate at 1.75% on Wednesday, January 8, 2019, as the economy slows as a result of lower oil prices, weaker housing activity and the U.S.-China trade clash. For homeowners and consumers, this means a reprieve of at least a few months from higher rates on mortgages and car loans.

The Bank of Canada insists it’s still committed to getting interest rates back up to neutral (2.5% – 3.5%) – the level where they are neither driving the economy forward nor slowing it down – but only “over time.”

“The appropriate pace of rate increases will depend on how the outlook evolves, with a particular focus on developments in oil markets, the Canadian housing market, and global trade policy,” added Bank of Canada Governor Stephen Poloz.

However, the bond market is focused on the facts: economic growth, Canadian’s savings, the oil sector, trade war, the housing market, consumer spending, the stock market and the US Federal Reserve. These facts tell a much more detailed story.

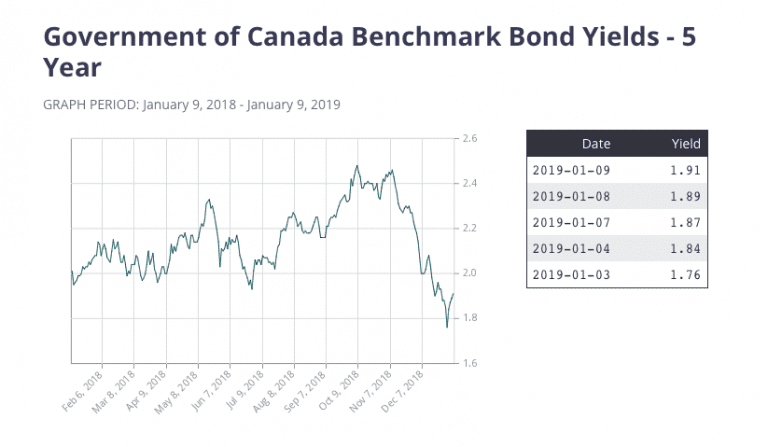

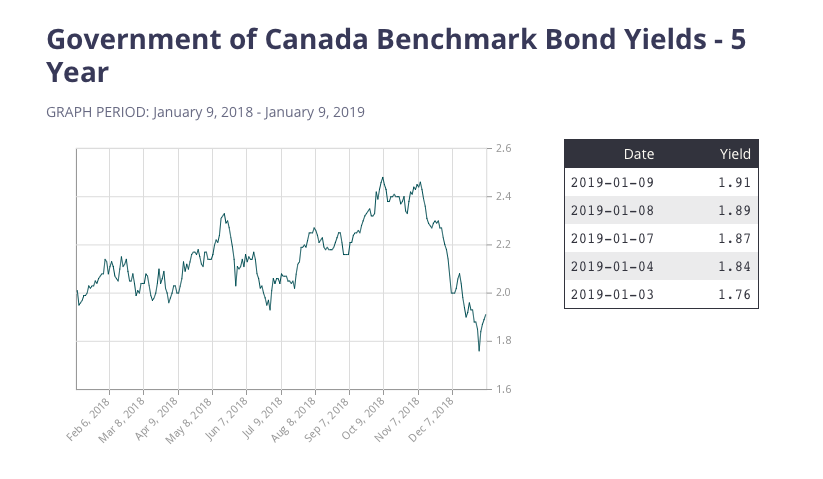

That’s why Canada’s five-year bond yield, which guides five-year fixed mortgage rates, has fallen all the way down to its one-year midpoint.

With all of these facts considered, if you are shopping for a mortgage and believe what the bond market is telling us, it implies your odds of success with a fixed rate may have just changed.

More people are going to take their chances with floating rates (variable and adjustable-rate mortgages). A rate near or under 3% gives you at least a 3 rate hike head start over conventional 5-year fixed rates. Few borrowers think that we are going to have over 4 rate hikes, so variable-rate popularity will rise.

In fact, during the last quarter of 2018, the CMHC (Canadian Mortgage Housing Corporation) saw the highest percentage of insured borrowers going variable since it started regularly publishing stats.

People are becoming more educated every day about the risk/reward of variables and their other benefits. RE/MAX All-Stars Benczik Team Realty has partnered with some of the best mortgage professionals in the business. Contact us if you have any questions on variable or fixed rate mortgages.

* Bond Market Pointing to Variable Rates was written by Benczik Team Realty

For more information on your home, visit our website and get a free home evaluation to ensure you get the best seller’s service! With experience around Markham, Stouffville, Unionville, and all of York Region, Benczik Team Realty works to serve you in the best way possible! Act now, and don’t miss out on this ever-growing market.