Breaking the Budget

Posted By: Rachel Kavanagh

Breaking the Budget – The federal budget was announced by Finance Minister Bill Morneau on Tuesday, March 19, with a large section targeting housing affordability. Billions of dollars in new incentives, including zero-interest mortgages for first-time buyers and subsidized loans for the construction of tens of thousands of rental units were introduced.

“Finding an affordable place to call home is not just a challenge. For too many hard-working Canadians, especially for young people, it feels like an impossibility, Mr Morneau indicated in his speech.

FIRST-TIME HOME BUYER INCENTIVE

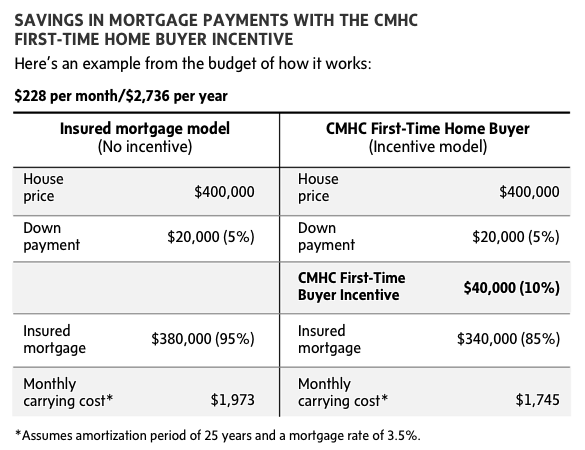

The centrepiece of Ottawa’s housing plan is a $1.25-billion, a three-year program of zero interest loans for low and middle-class income people looking to buy their first home. Canada Mortgage and Housing Corp (CMHC) will offer mortgage loans – up to 10% of the purchase price of newly built homes and 5% of existing homes to help prospective homeowners.

The loans will be available to people who provide down payments between 5-20% and have household incomes of $120,000 a year or less. The loan will be repayable when the mortgage is repaid. CMHC will release full details later this year, with the loans available in September, pending passage of legislation.

Example:

The new interest-free loan program will help first-time buyers, who are the group that has been most affected by the new stress-test rule. The solution avoids overstimulating the real estate market more broadly and spurring rapid growth in home prices in expensive markets.

HOME BUYERS’ PLAN INCREASE

First-time buyers will receive another boost as the government will be increasing the amount that Canadians can withdraw from their RRSPs to buy a home to $35,000 from $25,000, effective immediately.

NEW CONSTRUCTION AGREEMENT

The budget also proposed to extend for nine years an existing program of subsidized loans to builders of rental homes and apartments in areas with low vacancy rates. The upfront cost would be $10 billion. The extension in funding will boost the number of units built to 42,500 from 14,000.

The federal government has tried to appeal to the masses with this budget. They have introduced a few things to benefit first-time home buyers and although it is a small step, it is a small step in the right direction. Unfortunately, it will not be enough.

* Breaking the Budget written by Benczik Team Realty.

For more information on your home, visit our website and get a free home evaluation to ensure you get the best seller’s service! With experience around Markham, Stouffville, Unionville, and all of York Region, Benczik Team Realty works to serve you in the best way possible! Act now, and don’t miss out on this ever-growing market.