Canada’s Mortgage Qualifying Rate has Dropped

Posted By: Rachel Kavanagh

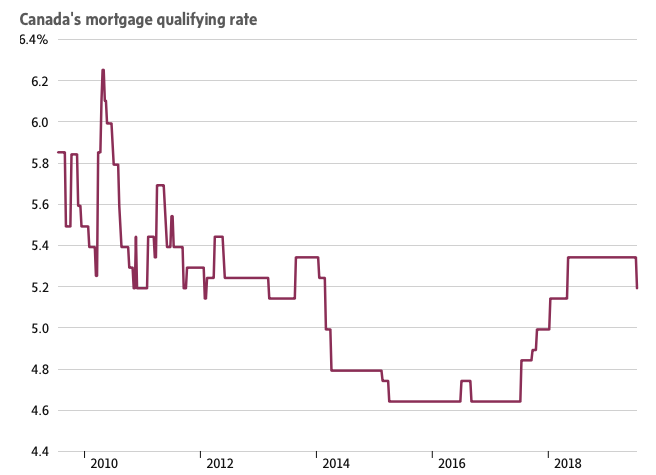

Canada’s Mortgage Qualifying Rate has Dropped – The interest rate used in Canada’s mortgage stress tests has fallen for the first time since 2016, making it slightly easier to become a homeowner.

The mortgage qualifying rate dropped to 5.19% from 5.34%, where it had been locked since May of 2018, according to figures from the Bank of Canada. The rate is derived from the most frequently occurring five-year, fixed post rates at Canada’s Big Six banks (TD, National Bank, CIBC, Royal Bank, Scotiabank, BMO).

The qualifying rate had increased several times during 2017 and 2018 as the Bank of Canada raised its key interest rate and as bond yields headed higher. However, in 2019 Canada’s five-year bond yield, which influences the direction of five-year fixed-rate mortgages tumbled. This decline along with mediocre economic data, the widely expected interest rate cut by the U.S. Federal Reserve at the end of July and the Bank of Canada pausing interest rate hikes have all contributed to the stress test rate cut.

The stress tests are used to ensure homeowners and prospective buyers can continue to afford their mortgage payments should interest rates increase. Currently, the tests only apply to federally regulated lenders, but there have been past discussions regarding extending the same tests to alternative lenders.

There are two mortgage stress tests. The first was implemented back in the fall of 2016 and applied to insured buyers or those who typically make a down payment of less than 20% of the home’s purchase price. In 2018, the Office of the Superintendent of Financial Institutions introduced a second stress test which applied to those individuals who provide down payments greater than 20%. Applicants are required to qualify for the higher of Bank of Canada five-year qualifying rate or the mortgage holder’s contracted rate +2%.

With the mortgage qualifying rate dropping, buyer’s affordability has increased. For example, for those making a 20% down payment and earning $100,000, they are eligible for an additional $8,300 in financing. Although it may not seem like much, when purchasing a home every dollar counts.

For those buyers looking to purchase, it might just be the psychological boost they need to get off the fence, get qualified and purchase the home they have been dreaming of.

* Canada’s Mortgage Qualifying Rate has Dropped – written by Benczik Team Realty

For more information on your home, visit our website and get a free home evaluation to ensure you get the best seller’s service! With experience around Markham, Stouffville, Unionville, and all of York Region, Benczik Team Realty works to serve you in the best way possible! Act now, and don’t miss out on this ever-growing market.