CMHC Insists Mortgage Stress Test Needed to Protect Economy

Posted By: Rachel Kavanagh

CMHC Insists Mortgage Stress Test Needed to Protect Economy – In response to the growing requests from industry groups to moderate the stress test Evan Siddall, chief executive of the Canada Mortgage and Housing Corp (CMHC) has written a letter to the House of Commons finance committee outlining that, “the mortgage stress test is exactly the kind of policy we need to protect our economy.” The stress test must be maintained to prevent a potential financial crisis from a “debt-fuelled real estate boom.”

The consequences of such a boom are serious and collapses of asset bubbles have historically created panic. Ten years after the last so-called crash, Mr Siddall mentions that “we have fallen into the ‘this time is different’ trap of complacency.” He adds in the letter that “We [CMHC] have a responsibility to prevent these tragedies. And while I’m not predicting, it nonetheless could happen here: Of the 46 banking crises for which we have housing data, over two-thirds were preceded by real estate boom and bust cycles.”

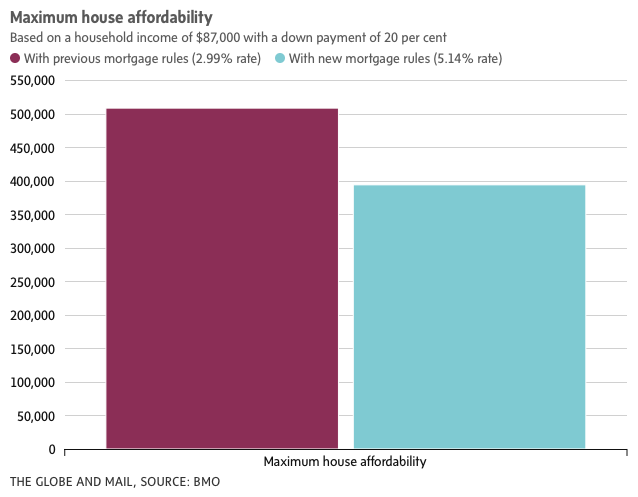

Canada’s banking regulator, the Office of the Superintendent of Financial Institutions (OSFI), introduced a stress test on uninsured mortgages – those with a down payment of 20% or more – in January, 2018, to curb risky lending practices, bringing such mortgages more in line with those of buyers putting down less than 20%. The stress-test rule requires borrowers to prove they could still afford their mortgages even if interest rates were two percentage points higher than the rate they negotiated with their banks, providing an affordability cushion if rates were to rise.

Since the start of 2018, home sales have fallen sharply, dropping 11% nationally last year. Sales declined the most in Canada’s two most expensive cities – 32% in the Vancouver region and 16% in the Greater Toronto Area – in 2018.

When comparing the first four months of 2018 to 2019 Markham real estate sales have increased by 12.6% and in Stouffville, real estate sales have increased by 6.9%. In fact, York Region as a whole has witnessed an increase of 11.7% in sales activity when compared to the same period in 2018.

Real estate groups have voiced their opinion and complained that the stress test is having unintended consequences and is keeping would-be buyers out of the market. Mr Siddall countered this in his letter by stating that the consequences are not unintended and that the policy is working as anticipated.

Part of the opinions issued by the industry suggested that it is safer now for the government to adjust the stress test because interest rates have risen since it was first implemented, reducing the risk of a major rate shock. Mr Siddall added that the main goal of the stress test is not to protect against interest-rate increases but to ensure Canadians can afford their mortgages if they face personal financial stresses.

The largest warning issued by Mr Siddall was about the growing level of household debt in Canada and how it is going to affect future spending if borrowers must dedicate more money to repaying their loans.

While the federal government announced a new first-time home buyers program in its March budget this year, which will provide $1.25-billion in interest-free loans over three years, Mr Siddall said its modest scale will have “a near insignificant impact on prices.”

The market continues to react differently to the stress test across the country. The OSFI has repeatedly said it is monitoring the impact of the B-20 stress-test rule on the Canadian housing market but has not offered any signal it could relax the measure.

CMHC Insists Mortgage Stress Test Needed to Protect Economy written by Benczik Team Realty